Financial

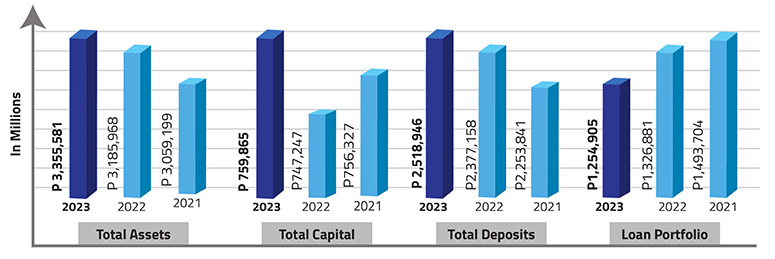

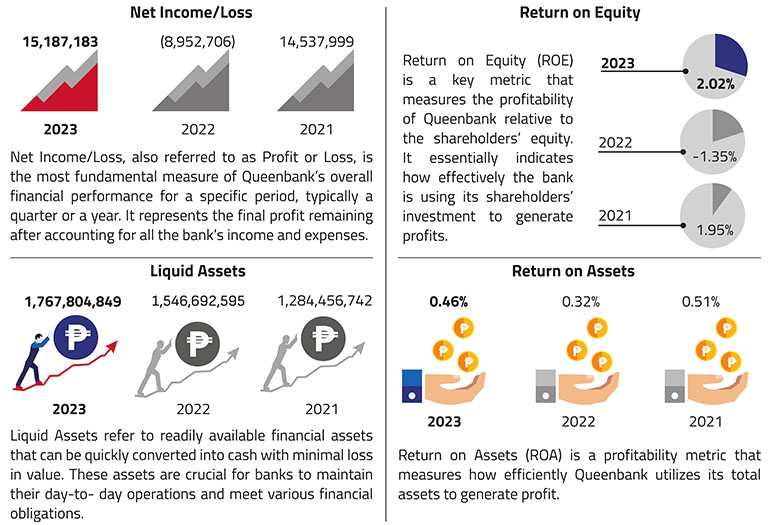

Queenbank maintains a strong balance sheet, and we continue to grow and optimize our deposit and loan portfolio. Queenbank provides financial services to individuals, corporations, and small and medium entrepreneurs. We offer a wide range of traditional products and services such as retail banking, consumption, agriculture, auto, housing, multi-purpose loan, and others.

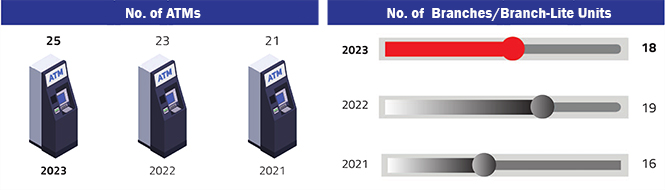

Network of Branches and ATMs

Queenbank has a reliable and expanding network of delivering its product and services.

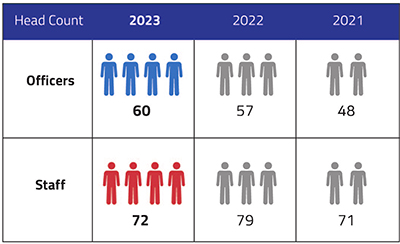

Human Resource

Queenbank is manned by capable and qualified employees having a total workforce of 132 as of the year ended December 31, 2023. Queenbank invests in our employees by providing regular training to foster their knowledge and career advancement.

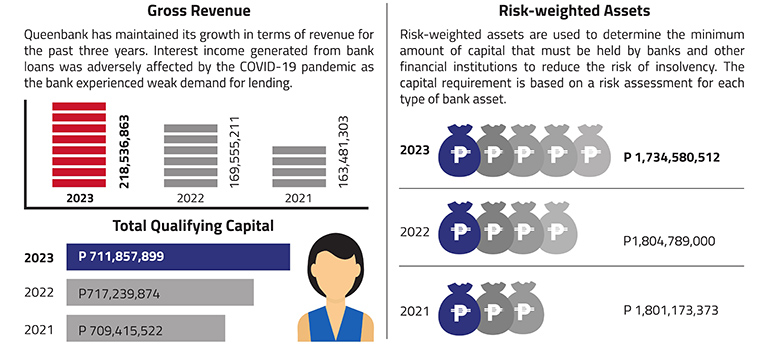

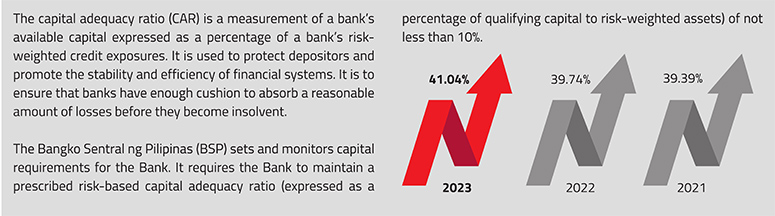

Transferring its Time Deposit placements with private universal banks to Government Securities is a strategic move by the bank to reduce its risk-weighted assets thereby improving its Capital to Risk Asset Ratio (CAR). While the BSP requires all banks to have a minimum of 10% CAR, Queenbank continues to boast a hefty 41.04% CAR as of December 31, 2023.

Total Capital Adequacy Ratio

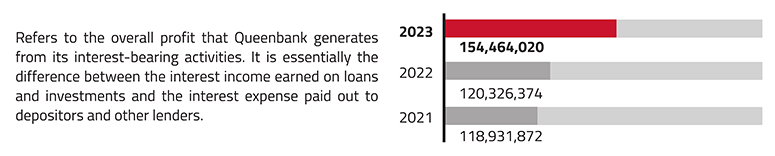

Total Net Interest Income

Please refer to the attached file.

Queenbank Financial Statements December 31, 2022 and 2023

Please refer to the attached file.

Queenbank's List of Acquired Assets for Sale

Please refer to the attached file.

Published Balance Sheet as of September 30, 2025

Published Balance Sheet as of June 30, 2025

Published Balance Sheet as of March 31, 2025

Published Balance Sheet as of December 31, 2024

Published Balance Sheet as of June 30, 2024

Published Balance Sheet as of March 31, 2024

Published Balance Sheet as of December 31, 2023