The Audit Committee is composed of three directors, two of whom are independent directors. Each member has adequate understanding at least or competence at most of the Bank’s financial management systems and environment. The committee is responsible for the review of the reports of internal and external auditors, assess the Bank’s internal controls and processes and oversee the proper implementation. It likewise ensures proper and timely response to all issues identified in audit processes.

Chairman: Alfredo V. MisajonMembers: Manuel J. Miraflores

Roy A. Cimatu Secretary: Rodolfo B. Pollentes

The Risk Oversight Committee ensures that the corporation is taking appropriate measures to properly balance risks and rewards in the areas of credit, operations, and technology. It also periodically reviews and approves the corporate risk management framework, including the development of effective policies, processes, and procedures as well as information in compliance with both internal and external regulations and internal policies.

Chairman: Manuel J. MirafloresMembers: Alfredo V. Misajon

Roy A. Cimatu Secretary: Rodolfo B. Pollentes

The Related Party Transactions Committee has the

primary responsibility of ensuring that transactions

with related parties are done on an arm’s length basis,

evaluating on an ongoing basis, existing relations

between and among businesses and counterparties

to ensure that all related parties are continuously

identified, RPTs are monitored, and subsequent

changes in relationships with counterparties from

non-related to related and vice versa are captured.

Note: Same Chairman and Members with Risk Oversight

Committee

The Assets and Liability Committee (ALCO) identifies, monitors, and manages the bank’s exposure to the following risk areas, namely, Liquidity Risk, Interest Rate Risk, Market Risk, Foreign Exchange Risk, Market Risk, Regulatory, and Credit Risk. It also develops strategies, oversees, and formulates risk tolerances in the risk management process. It is comprised of four members of the Board, three of whom are Executive Officers, Department Heads representing the Portfolio Administration Unit, Treasury, Central Accounting Group, and the Chief Compliance Officer. This committee meets every month regularly.

The Credit Committee is organized to assist the Bank’s Board of Directors in fulfilling its corporate responsibilities by providing oversight on the Bank’s credit activities, specially in identifying, assessing, measuring, monitoring and managing the Bank’s credit risk. It is comprised of three (3) Executive Directors including the President, Commercial Banking Group, and Chief Operations Officer. This committee meets as often as may be required on such date and time as determined by the Chairman of the Committee.

Chairman: Enrico O. JacomilleMembers: Margaret Ruth C. Florete

Dante A. Javellana Marguilyn V. Tajonera Secretary: Ma. Alyssandrea Nicole Ongo

The Information Technology Steering Committee (ITSC) is a committee created and appointed by the Board to oversee and to exercise governance over the Bank’s IT function. The ITSC shall be composed of one (1) Independent Director, the President, the Consumer Banking Group Head, the Chief Operations Officer, and the Systems Group Head (Systems Administrative Head and Systems Technical Head) of Queenbank.

Chairman: Alfredo V. MisajonMembers: Margaret Ruth C. Florete

Enrico O. Jacomille Dante A. Javellana Jannie B. Tuvida Rey Charles C. Zaldivar Antonio S. Sapio (Advisory Capacity) Francisco G. Jordan (Advisory Capacity) Rutherine S. Robles (Advisory Capacity) Secretary: Atty. Rodolfo B. Pollentes Jr.

The Chairman of the Board provides leadership by ensuring the effective function of the Board, including maintaining a relationship of trust with board members. The Chairman ensures that the board takes an informed judgment through a sound decision-making process, encourages and promotes critical discussions, and ensures dissenting views are expressed and fully considered. The Chairman makes certain that the agenda of the meeting focuses on strategic matters, including the overall risk appetite of the Bank, the development in the business and regulatory environments, key governance concerns, and contentious issues that significantly affect operations.

The Bank’s Board of Directors is primarily responsible for approving and overseeing the implementation of the bank’s strategic objectives, risk strategy, corporate governance, and corporate values. Further, the Board of Directors is also responsible for monitoring the performance of senior management as the latter manages the day-to-day affairs of the Bank leading toward the attainment of its goals for the interest of the institution, its shareholders, and other stakeholders. It is composed of 8 directors including two independent directors.

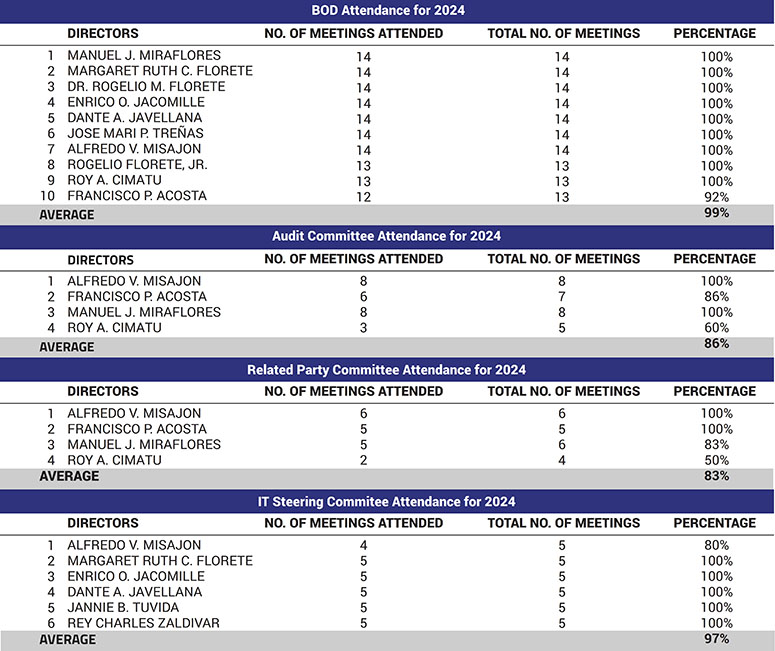

The Board is in charge of the selection of new directors. It evaluates the skills, knowledge, and experience of the potential candidates. For the reelection of incumbent directors, his or her overall contributions to the board, the results of the self-assessments, and attendance records in meetings are being considered.

The Board is also in charge of the appointment/selection of competent key members of senior management led by the President including the heads of control functions such as Chief Compliance Officer, Chief Risk Officer, and Internal Audit Head. Fit and proper standards such as his/her integrity, education, training, and possession of competencies relevant to the function such as knowledge and banking experience, skills, and diligence are applied in the selection of key officers.

The Chief Compliance Officer should have the necessary qualifications as mentioned in the applicable provisions of the Manual of Regulations for Banks, considering his or her experience, and professional background, and should have a sound understanding of relevant laws and regulations and their potential impact on the bank’s operations. He or she should be up-to-date with the developments in laws, rules, and standards maintained through continuous training.

Internal Audit Head must have unassailable integrity, relevant education/ experience/training, and an understanding of the risk exposures of the bank, as well as competence to audit all areas of its operations. He must also be a graduate of any accounting, business, finance, or economics course with technical proficiency in the conduct of the internal audit and must have at least two (2) years of experience in the regular audit.

The Board holds its regular monthly meetings and special meetings, if necessary, to discuss and deliberate the Bank’s actions.